Still Bearish on Russia? Why Analysts Shouldn’t Underestimate the Russian Economy

Putin's Economy Soldiers on Despite the International Pressure

One year ago, many in Western media and government speculated that Russia was weeks or months away from complete economic implosion1. However, many of these doom and gloom predictions have failed to materialise. So how has the Russian economy soldiered on despite hundreds of sanctions, a slumping Ruble, and an unprecedented decoupling from their Western neighbours?

“We are a Gas Station With Nukes”

Is how Russia was once described to me by a well connected Muscovite a year before the Ukraine War. This morose quip is actually a fairly good interpretation of the fossil fuel economy’s importance. The Russian State is almost entirely reliant on their resource and fossil fuel exports. Over 40% of exports come from crude petroleum and petroleum gas alone. Although Russian exports took a significant hit in the months following the invasion of Ukraine, they have largely recovered, with oil prices at record highs and a slew of new buyers eagerly emerging.

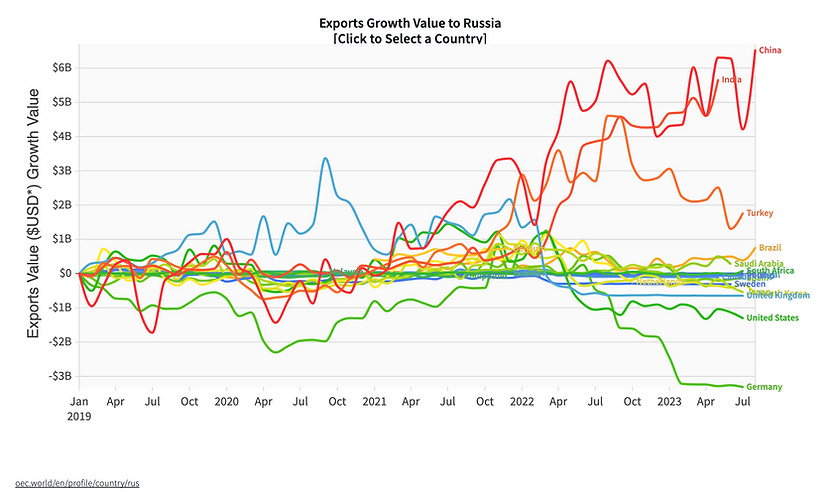

Russian exports to India have skyrocketed a massive 1,500%2. India, who has been relatively neutral on the conflict in Ukraine, imports Russian oil at a discount, repackages it, and ships it to Europe for a premium3. This blatant work-around has been enormously profitable for Indian companies, and has allowed Russian oil to flow into Europe despite the strict sanctions.

Exports to China have also grown an impressive 126%. Although Russian efforts to complete an ambitious 2nd pipeline to China are stalling, Russia has figured out a clever workaround to international sanctions, a massive fleet of untraceable tankers 4. Russia has amassed a sizeable 400+ tanker fleet of ships which it is utilizing to export fossil fuels, undercutting the G7 price cap and international sanctions5. This fleet, largely registered with faceless companies in the Gulf nations, has, and will continue to be, a critical lifeline for Russia’s exports. Shock reports now indicate that Russia’s GDP will rise 2.2% in 20236. The Russian’s incredible ability to outmanoeuvre international sanctions is largely to credit for this bullish result.

Russia’s main weakness therefore lies in the price of oil itself. In the past, the economy has experienced major slumps when the international price of oil drops. However, inflationary pressures, increasing demand, and the instability of both the Ukraine War and the Middle East escalations are likely to contribute to higher prices for several years7.

Trade has also increased with a myriad of regional neighbours, such as Kyrgyzstan, Kazakhstan, and even with NATO member Turkey. These members also assist in importing banned goods to Russia. Despite all the tough rhetoric from sympathising transnational corporations, one can still find Coca-Cola, Adidas, and other iconic Western products for sale in Russian cities. In addition, several major Western corporations such as Shell Energy, Unilever, and Cloudfare have refused to decouple from Russia and continue to trade to the tune of hundreds of millions8. These third party nations and trade outlets have protected imports to Russia, insulating Russians from the intended effects of the sanctions blockade.

The Consolidation of the Oligarchy

Western Governments responded to Russia’s invasion with precise, targeted sanctions on hundreds of individuals in Russia’s elite class. These oligarchs were stripped of assets, shell companies, yachts, bank accounts, sports teams, and had their international presence completely upended. The stated policy goal was to disrupt the powerful ‘informal’ institutions in Russia, and to ultimately to mobilise the oligarchs against Putin. These policies were bound for failure. Leading academics on this topic, such as Dr. David Siegel, propose that sanctions actually bring the Oligarchy closer to Putin.

Rather than destabilising Putin’s rule through internecine battles among oligarchs fighting for increasingly scarce resources, U.S. sanctions might, in fact, be a centripetal force in Russia’s informal politics, uniting oligarchs together as a social class with the common interest of defending their wealth against American hegemony. Put differently, U.S. sanctions have made Russian oligarchs more willing to make personal sacrifices to achieve the long-term objective of autonomy and independence from American power and the threat that it poses to their wealth. (Siegel 2021)

Many of these Oligarchs have been rewarded for loyalty through the turbulence. Putin has rewarded his inner circle with diplomatic status9, infrastructure projects, and access to the resource riches of the captured territories10. The Oligarchy is perhaps more united than ever before, and now their assets and wealth have been repatriated to Russia as their capital outlets elsewhere close for good.

Prigozhin’s bold march on Moscow ironically showcased this unity from the Oligarch class. Although optimists in the West hoped it may lead to an end to the War, regime change, or even Putin’s demise, the march fizzled. The Oligarchs remained loyal and widespread revolt failed to materialise. Prigozhin’s erratic decision was reduced to individual posturing, and he was quickly dispatched. If anything, this event further cemented Putin’s absolute claim to power. Putin is head of the patronal system, Tsar of the Oligarchy.

The Shadow Banking System

Western politicians boasted that the 2022 exclusion of Russia from SWIFT, the main international transaction mechanism, would devastate Russia and bring its capital flows to a halt. However, they greatly underestimated Russia’s preparation. Russian economic forces have been anticipating such an exclusion for nearly a decade. Since 2014, Russian businesses, banks and Oligarchs have figured out increasingly complex and devious methods to obfuscate their holdings and insulate their capital abroad. As Russia’s Central Bank has been heavily restricted from exchanging foreign currency reserves, experts believe the Russian government is using dozens of intermediary corporations to conduct transactions on their behalf. These quasi-state owned businesses have moved billions in funds from the West into “China, India, Hong Kong and the United Arab Emirates”11.

Anti-War Fatigue?

Many around the world are also succumbing to what I would term ‘Anti-War Fatigue’, war acceptance, or the tiring of being anti-war. After many many months of relative stasis in the war’s progress, a growing number of Russians are returning from self-exile12. Their greatest fears do not appear to be materialising, Putin has consolidated power in the wake of Prigozhin’s death, and another mobilization appears unlikely in the short term. These educated and wealthier Russians will return jaded, but with cash and the means to consume goods.

Other nations are softening their stance towards Russia as they come to terms with a long war. Slovakia’s new ruling government is expressly opposed to further Ukraine aid, Hungary’s Orban calls it a “lost cause”, Poland has faltered on further arms, and overall European public commitment is showing cracks13. To complicate matters, the rising Middle East conflict will only draw support away from Ukraine as nations shift priorities.

An Ability to go the Long-Run

Many in the West have optimistically predicted that a breakdown of Russian forces is imminent, and could lead to the collapse of the Russian economy. These idealists have not taken into account Russia’s deep supplies and deeper pockets. Russia recently purchased “over 300,000 artillery rounds”14 from North Korea, outpacing even American commitments to Ukraine in similar weaponry. Russia has used an enormous amount of its munitions, but the Soviet-era arsenals have incredible depth, and can serve Russia’s military for years to come15.

The depth of Russian munitions and supplies has allowed Russian forces to weather the intense onslaught from the Ukrainian counteroffensive, ceding only a few miles of territory in months of fighting. Their economic demise will not come about due to shortages and failures on the battlefield.

Things are certainly not good for the Russian economy, but they are far from apocalyptic. Russia’s exports are growing, its Oligarchy is solid, the arms industry is resilient, and international credit still flows through the veins of the Russian system. While it is easier in the West to discuss the negative economic aspects of Russia’s War on Ukraine, it is time to accept the facts. Russia’s economy is solid, and their ability to wage war will not evaporate any time soon.

Sources:

MARIN, Ludovic. “French finance minister: We will bring about collapse of the Russian economy.” The Local France, 1 March 2022, https://www.thelocal.fr/20220301/french-finance-minister-we-will-bring-about-collapse-of-the-russian-economy. 2023.

Narayan, Mohi, and Nidhi Verma. “Fuels from Russian oil gets backdoor entry into Europe via India.” Reuters, 5 April 2023, https://www.reuters.com/business/energy/fuels-russian-oil-gets-backdoor-entry-into-europe-via-india-2023-04-05/.

Soldatkin, Vladimir, and Kevin Liffey. “Russia finalising Power of Siberia-2 gas pipeline route to China, Novak says.” Reuters, 6 September 2023, https://www.reuters.com/business/energy/russia-finalising-power-siberia-2-gas-pipeline-route-china-novak-2023-09-06/.

“Russia GDP Annual Growth Rate.” Trading Economics, https://tradingeconomics.com/russia/gdp-growth-annual

Stockbruegger, Jan. “The threat from Russia's fleet of 'ghost tankers.'” EUobserver, 13 April 2023, https://euobserver.com/opinion/156916.

Mackintosh, Phil. “Oil Prices Will Remain High For Years To Come.” Nasdaq, 26 October 2021, https://www.nasdaq.com/articles/oil-prices-will-remain-high-for-years-to-come-2021-10-26.

Sonnenfeld, Jeffrey. “'The Feckless 400': These companies are still doing business in Russia–and funding Putin's war.” Fortune, 11 July 2023, https://fortune.com/2023/07/11/the-feckless-400-these-companies-are-still-doing-business-in-russia-funding-putins-war-sonnenfeld-tian/.

Sonnenfeld, Jeffrey. “'The Feckless 400': These companies are still doing business in Russia–and funding Putin's war.” Fortune, 11 July 2023, https://fortune.com/2023/07/11/the-feckless-400-these-companies-are-still-doing-business-in-russia-funding-putins-war-sonnenfeld-tian/.

Soldatkin, Vladimir, and Olesya Astakhova. “Exclusive: Russia's top oil and gas chiefs to accompany Putin on China visit.” Reuters, 25 September 2023, https://www.reuters.com/business/energy/russias-top-oil-gas-chiefs-accompany-putin-china-visit-2023-09-25/.

Brown, Steve, and Stefan Korshak. “Russia's Rebuilding of Mariupol Attracts Buyers Who 'Want a Place by the Sea.'” Kyiv Post,

Hosp, Gerald, and Sergei Karpukhin. “Russia is likely building shadow reserves abroad.” NZZ, 5 September 2023, https://www.nzz.ch/english/russia-is-likely-building-shadow-reserves-abroad-ld.1754540.

Weaver, Courtney. “The Russians returning home from self-imposed exile.” Financial Times, 25 October 2023, https://www.ft.com/content/5e6bcce9-7bda-4b29-b1b7-f7df6e879fd9.

Adler, Nils. “As Russia's war grinds on, is global support for Ukraine waning?” Al Jazeera, 4 October 2023, https://www.aljazeera.com/news/2023/10/4/is-global-support-for-ukraine-waning.

Sauer, Pjotr. “Evidence mounts of North Korean arms to Russia in threat for Ukraine.” The Guardian, 27 October 2023, https://www.theguardian.com/world/2023/oct/27/north-korean-arms-supply-russia-war-ukraine-munition-shipments.

Faulconbridge, Guy, and Andrew Osborn. “Russia ramps up output of some military hardware by more than tenfold - state company.” Reuters, 19 September 2023, https://www.reuters.com/world/europe/russia-ramps-up-output-some-military-hardware-by-more-than-tenfold-state-company-2023-09-19/.

-Other sources

Siegel, D. 2021. From Oligarchs to Oligarchy: The Failure of U.S. Sanctions on Russia and its Implications for Theories of Informal Politics. St. Joseph's College.

An important factor is that, contrary to Western propaganda, the majority of the Public support Putin. Buying Chinese products with dual purpose technology helps. And lancet drones, proudly Russian made, etc. have proven to be highly effective.

For reasons that still remain unexplained, the US in 2022 staked and subsequently lost both its best weapon (economic sanctions) and the future prospects of its biggest ally (EU). The gambit was a programme of economic warfare v s Russia, which could succeed if and *only if* the US secured cooperation of China. China having been antagonized non-stop by the US since 2018 in unforgivable ways, including kidnapping of Meng Wenzhou, costly attempts to delay Chinese chip manufacturing, attempting to foment separatists in Hong Kong, and providing military assistance to Taiwan.

With the support of China backstopping general industry, Russia had little trouble replacing European imports. US, characteristically, didn't even respect its own policy. Apple products still sell in Russia by the way, in Apple stores. US still buys Russian oil products directly. EU, meanwhile, faces reversal of the 30% energy cost advantage compared to East Asia it enjoyed pre-war, which has now reversed to a 30% disadvantage. It is now compelled to dismantle its heavy industry. Chinese currency has overtaken Euro for second place in global goods trade. There is a significant likelyhood of far right governments after the coming round of elections.